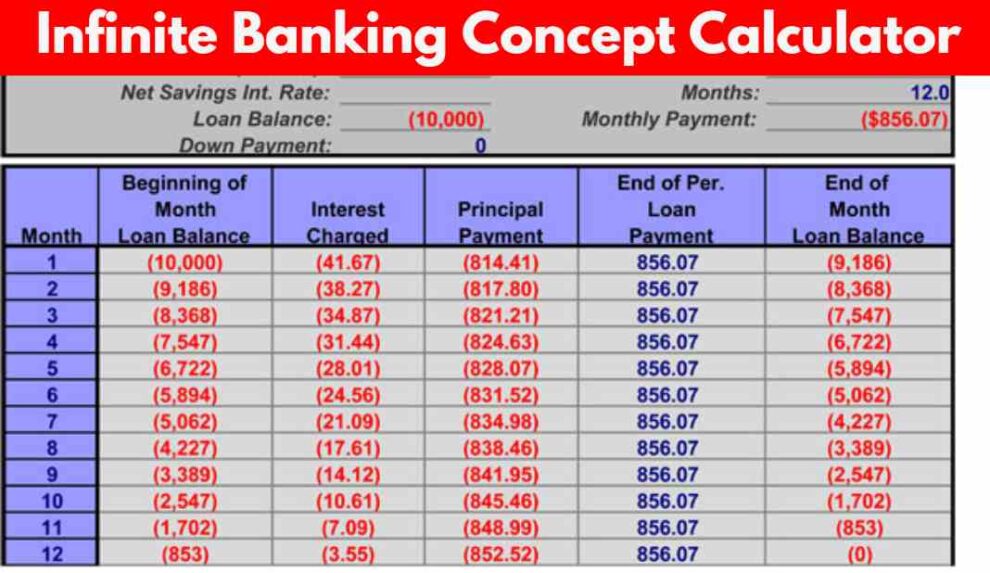

One way of managing your finances with life insurance is known as infinite banking or. And if you’re considering implementing an infinite banking approach, it is essential for you to understand how to use an infinite banking concept calculator to determine the rate of return.

You must evaluate your return on investment because conducting some basic math would allow you to make better financial decisions. By doing the math, you advance and understand the actual value of the savings in terms of return.

What is Infinite Banking?

A possible way to act as your own banker is infinite banking, often known as overfunded life insurance. You can use your life insurance to launch this, taking on the role of your banker minus a financial institution’s high costs and interest rates. Further, the dramatic increase in availability or cash flow is among the essential benefits of infinite banking.

How does Infinite Banking Work?

Every time the insurance provider pays dividends, the cash value of your insurance policy increases. These dividends are worthwhile even though they don’t seem like much in the short term. When you add this to the guaranteed interest rate, you have a tool for generating wealth. Your cash value’s ongoing growth produces a compounding impact. You may not be able to withdraw money from the cash value of your policy, but you can take a loan from the insurance company against it, effectively taking a loan from yourself rather than a lender (or other lending institution). The best thing is that your money keeps growing, and your cash value is unaffected.

Like many different types of life insurance, infinite banking coverage has eligibility requirements. People with health issues have a more challenging time qualifying because age and health are the factors considered by all life insurance providers. On the other hand, whole life insurance eligibility is more accessible to obtain than term life insurance. It is advised against applying for term life insurance if you have health concerns because the companies might deny your application.

What are the different types of infinite banking concept calculators?

Based on the needs and requirements of customers, there are different types of infinite banking concept calculators. These mainly include:

- Automobile Purchases

- Borrowing Strategy

- Cash Flow

Most calculators require payment. Find a trial time for each before making a purchase. If there is an offer for a trial period, test it out and practice using it to determine if it meets your needs.

With the help of the most effective concept calculator that suits your needs and requirements, you can manage your life insurance policy efficiently.

Final Words:

This guide has been formulated to thoroughly understand an infinite banking concept calculator. It will not only help you in the process of life insurance but also provide you with ideas and notions related to it. Remembering the above tips and information will help you make a substantial decision in the financial sector.

Add Comment